http://news.yahoo.com/court-may-limit-race-college-admission-decisions-133238785.html

This article was about how the courts may limit the decisions that a college can make with race. This case was brought up because a girl felt like she was wrongly rejected by a college while minorities with similar grades and test scores were accepted.

Monday, April 29, 2013

9 Ways to Get Rich Quicker

http://www.kiplinger.com/slideshow/business/T064-S002-how-to-get-rich-quicker/index.html

This list includes different ways to invest in different ideas. Whether it be your own or someone else's, there are still precautionary measures to be taken. Some different ways to get rich fast are; Starting a new business, invent something new, invest aggressively, flip real estate, and become a landlord. These also all include their own rate of risk to consider.

Cities With the Best Credit Scores 2012

1. Wausau, Wis.

Henryk Sadura/Getty ImagesCity averages:

Henryk Sadura/Getty ImagesCity averages:

Credit Score: 789

Debt: $22,439

Number of Late Payments: 0.27

% Credit Available: 77.52

Number of Open Credit Cards: 1.71

The highest-ranking city is Wausau, Wis., a remarkable development considering that in the previous year, it didn’t even make the list. Interestingly, of all 10 cities on this list, four including Wausau, are in Wisconsin. When it comes to managing personal credit and debt, the people of Wisconsin must be doing something right.

2. Minneapolis, Minn.

Greg Benz/Flickr/Getty ImagesCity averages:

Greg Benz/Flickr/Getty ImagesCity averages:

Credit Score: 787

Debt: $24,994

Number of Late Payments: 0.26

% Credit Available: 73.45

Number of Open Credit Cards: 2.08

In the previous year, Minneapolis, Minn., proudly topped the “State of Credit” list. However, times change, and during the most recent survey period, it fell one spot. Still, its average credit score of 787 is impressive, and the city owes it in part to a low unemployment rate of 6.9 percent, and a median family income of $82,700. On the negative side, it had 786 foreclosures.

3. Madison, Wis.

Original photography by Neos Design - Cory Eastman/Flickr/Getty ImagesCity averages:

Original photography by Neos Design - Cory Eastman/Flickr/Getty ImagesCity averages:

Credit Score: 785

Debt: $23,533

Number of Late Payments: 0.27

% Credit Available: 75.90

Number of Open Credit Cards: 1.79

Madison, Wis., has fallen one spot to number 3, but like Cedar Rapids, the city is still in good standing despite the slippage. It has a lower-than-average unemployment rate at 6 percent, a higher-than-average median family income of $81,800 and a high percentage of available credit.

4. Cedar Rapids, Iowa

J Wynia/FlickrCity averages:

J Wynia/FlickrCity averages:

Credit Score: 781

Debt: $23,628

Number of Late Payments: 0.32

% Credit Available: 76.57

Number of Open Credit Cards: 1.82

Like most of the cities on this list, Cedar Rapids, Iowa, has fallen one spot since the previous year. Still, number 4 isn’t a bad place to be. Its high placement is due in part to a high percentage of available credit and a low unemployment rate of 6 percent.

5. San Francisco

Travelpix Ltd/Photographer's Choice/Getty ImagesCity averages:

Travelpix Ltd/Photographer's Choice/Getty ImagesCity averages:

Credit Score: 781

Debt: $23,973

Number of Late Payments: 0.30

% Credit Available: 72.83

Number of Open Credit Cards: 2.02

At number 5, San Francisco is the only city on this list to retain its ranking from the previous year. Its residents have a relatively high number of open credit cards and a relatively low percentage of available credit. At the time of the survey, the city had a 10 percent unemployment rate, higher than the national average of 9.2 percent. But at $101,600, San Francisco is the only city on this list with a six-figure median family income, which helps it to retain its foothold.

Henryk Sadura/Getty ImagesCity averages:

Henryk Sadura/Getty ImagesCity averages:Credit Score: 789

Debt: $22,439

Number of Late Payments: 0.27

% Credit Available: 77.52

Number of Open Credit Cards: 1.71

The highest-ranking city is Wausau, Wis., a remarkable development considering that in the previous year, it didn’t even make the list. Interestingly, of all 10 cities on this list, four including Wausau, are in Wisconsin. When it comes to managing personal credit and debt, the people of Wisconsin must be doing something right.

2. Minneapolis, Minn.

Greg Benz/Flickr/Getty ImagesCity averages:

Greg Benz/Flickr/Getty ImagesCity averages:Credit Score: 787

Debt: $24,994

Number of Late Payments: 0.26

% Credit Available: 73.45

Number of Open Credit Cards: 2.08

In the previous year, Minneapolis, Minn., proudly topped the “State of Credit” list. However, times change, and during the most recent survey period, it fell one spot. Still, its average credit score of 787 is impressive, and the city owes it in part to a low unemployment rate of 6.9 percent, and a median family income of $82,700. On the negative side, it had 786 foreclosures.

3. Madison, Wis.

Original photography by Neos Design - Cory Eastman/Flickr/Getty ImagesCity averages:

Original photography by Neos Design - Cory Eastman/Flickr/Getty ImagesCity averages:Credit Score: 785

Debt: $23,533

Number of Late Payments: 0.27

% Credit Available: 75.90

Number of Open Credit Cards: 1.79

Madison, Wis., has fallen one spot to number 3, but like Cedar Rapids, the city is still in good standing despite the slippage. It has a lower-than-average unemployment rate at 6 percent, a higher-than-average median family income of $81,800 and a high percentage of available credit.

4. Cedar Rapids, Iowa

J Wynia/FlickrCity averages:

J Wynia/FlickrCity averages:Credit Score: 781

Debt: $23,628

Number of Late Payments: 0.32

% Credit Available: 76.57

Number of Open Credit Cards: 1.82

Like most of the cities on this list, Cedar Rapids, Iowa, has fallen one spot since the previous year. Still, number 4 isn’t a bad place to be. Its high placement is due in part to a high percentage of available credit and a low unemployment rate of 6 percent.

5. San Francisco

Travelpix Ltd/Photographer's Choice/Getty ImagesCity averages:

Travelpix Ltd/Photographer's Choice/Getty ImagesCity averages:Credit Score: 781

Debt: $23,973

Number of Late Payments: 0.30

% Credit Available: 72.83

Number of Open Credit Cards: 2.02

At number 5, San Francisco is the only city on this list to retain its ranking from the previous year. Its residents have a relatively high number of open credit cards and a relatively low percentage of available credit. At the time of the survey, the city had a 10 percent unemployment rate, higher than the national average of 9.2 percent. But at $101,600, San Francisco is the only city on this list with a six-figure median family income, which helps it to retain its foothold.

‘Cops vs. Kids’ basketball games benefit local teen battling cancer

http://www.thereporteronline.com/article/20130429/NEWS01/130429537/-cops-vs-kids-basketball-games-benefit-local-teen-battling-cancer

A basketball game benefit with cops vs. kids was held in honor of a seventh grader that is fighting cancer since fall. The middle schoolers won 34-19 against the officers. Firetrucks painted there trucks pink in representation of kids battling cancer. Other kids with cancer were seen at the benefit showing the struggles in cancer. Donations were given to support the family of the 14 year old. Raffle tickets were sold for gift baskets to raise money.

A basketball game benefit with cops vs. kids was held in honor of a seventh grader that is fighting cancer since fall. The middle schoolers won 34-19 against the officers. Firetrucks painted there trucks pink in representation of kids battling cancer. Other kids with cancer were seen at the benefit showing the struggles in cancer. Donations were given to support the family of the 14 year old. Raffle tickets were sold for gift baskets to raise money.

Squeaky Wheel

http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html

Don't stop at "No"

Start local

Fill out the card

Be nice

Be armed

Don't stop at "No"

Put it in writing

Start local

Fill out the card

Is a mortgage a smart way to pay for college?

http://www.usatoday.com/story/money/personalfinance/2013/04/13/paying-for-college-mortgage/2071033/

I am not sure taking out a home loan to pay for your kids college education is the best decision, either. You would be putting your home at risk, which isn't a good idea. And never let the tax benefits influence your financial decision. You can only deduct the interest on your mortgage if you are itemizing your deductions, and even then you would only benefit from the amount of deductions that are greater than the standard deduction ($11,900 for 2013). This means if you take out a mortgage and then have $13,000 of itemized deductions, you really only benefit from a $1,100 deduction. Multiply this deduction by your tax rate to get the actual tax benefit, and you will find that it really isn't all that much

I am not sure taking out a home loan to pay for your kids college education is the best decision, either. You would be putting your home at risk, which isn't a good idea. And never let the tax benefits influence your financial decision. You can only deduct the interest on your mortgage if you are itemizing your deductions, and even then you would only benefit from the amount of deductions that are greater than the standard deduction ($11,900 for 2013). This means if you take out a mortgage and then have $13,000 of itemized deductions, you really only benefit from a $1,100 deduction. Multiply this deduction by your tax rate to get the actual tax benefit, and you will find that it really isn't all that much

The World's First Stock Market Crash Happened Nearly 300 Years Ago

http://www.businessinsider.com/the-worlds-first-stock-market-crash-happened-nearly-300-years-ago-2013-4

By 1710, England was experiencing there first ever stock market crash, this was called the South Sea Company Bubble. England had loans, expended money with little financial oversight, and they were trying to finace their soldiers. England had about £10 million of debt.

By 1710, England was experiencing there first ever stock market crash, this was called the South Sea Company Bubble. England had loans, expended money with little financial oversight, and they were trying to finace their soldiers. England had about £10 million of debt.

Personal Finance: Learn to be a 'squeaky wheel' Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html

Be nice

If you start off angry or arrogant, you'll likely get shut down quickly.

Be armed

Don't pick up the phone, go online or write a letter until you have essential details: serial numbers, date of purchase, warranty information, etc. If you're shuffling papers or unsure of details or vague about what you want, you're not going to sound like someone who should be listened to.

Don't stop at "No"

Many consumers give up too easily, especially when they encounter a brusque or unhelpful customer service rep. "You need to appeal any decision you get … Companies are not in business to lose customers."

Put it in writing

Often, the most effective way to lodge a complaint is to write a letter.

Start local

Begin with the store where you bought the item.

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Fill out the card

Consumer Reports says you should always fill out the paper warranty card that comes with most major purchases. Even though it's not required to activate the warranty.

Warranty or not

Even if your warranty has expired, it doesn't mean there's no point in trying. Giorgianni says the legal concept of "implied warranty" means there's a reasonable expectation that a product should be workable and usable.

Tweet it; post it

Social media can be an ally, as well. Many companies have Facebook pages where you can post your beef on a message board. The sites are monitored and you'll often get a reply from a company rep. Same with message boards on the company's website.

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Put it in writing

Often, the most effective way to lodge a complaint is to write a letter.

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Inevitably something goes wrong with something you've bought. What do you do?Too many of us just give up or don't bother trying to get the store or company to resolve the problem.We live in a buck-up-and-take-it society, we're not going to plead for anything; we're just going to take it. We have a subconscious feeling that when we speak out, we're viewed as a complainer.Not all consumers are treated equally. If you're persistent and know how to complain effectively, you're more likely to get a remedy.Companies have two types of responses to complaining customers: those who get the quick brush-off and the "squeaky wheels" who merit some attention.

There's an art to getting good customer service. Here's how:

Be nice

If you start off angry or arrogant, you'll likely get shut down quickly.

Be armed

Don't pick up the phone, go online or write a letter until you have essential details: serial numbers, date of purchase, warranty information, etc. If you're shuffling papers or unsure of details or vague about what you want, you're not going to sound like someone who should be listened to.

Don't stop at "No"

Many consumers give up too easily, especially when they encounter a brusque or unhelpful customer service rep. "You need to appeal any decision you get … Companies are not in business to lose customers."

Put it in writing

Often, the most effective way to lodge a complaint is to write a letter.

Start local

Begin with the store where you bought the item.Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Fill out the card

Consumer Reports says you should always fill out the paper warranty card that comes with most major purchases. Even though it's not required to activate the warranty.

Warranty or not

Even if your warranty has expired, it doesn't mean there's no point in trying. Giorgianni says the legal concept of "implied warranty" means there's a reasonable expectation that a product should be workable and usable.

Tweet it; post it

Social media can be an ally, as well. Many companies have Facebook pages where you can post your beef on a message board. The sites are monitored and you'll often get a reply from a company rep. Same with message boards on the company's website.

Ultimately, being a squeaky wheel means "not being afraid to ask," said Papantoniadis. "You have to go in with the idea that you don't expect anything. And the worst they can say is 'No.' "

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Put it in writing

Often, the most effective way to lodge a complaint is to write a letter.Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

If you don't get a satisfactory answer, "go up the food chain," he advises. Ask to speak to a supervisor or manager. If necessary, take it to the CEO's office.

"You need to appeal any decision you get … Companies are not in business to lose customers."

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

There's an art to getting good customer service. Here's how:

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

companies have two types of responses to complaining customers: those who get the quick brush-off and the "squeaky wheels" who merit some attention.

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Read more here: http://www.sacbee.com/2013/04/28/5375422/learn-to-be-a-squeaky-wheel.html#storylink=cpy

Microsoft Pays Higher Rate to Beat Apple Sale: Corporate Finance

http://www.bloomberg.com/news/2013-04-29/microsoft-pays-higher-rate-to-beat-apple-sale-corporate-finance.html

Microsoft is paying a higher rate to beat / compete with apple sales.

Microsoft is paying a higher rate to beat / compete with apple sales.

Seven steps to paying for college

http://www.ajc.com/news/business/seven-steps-paying-college/nXDgd/

This is an article that is giving some steps to help pay for college. Getting into college is hard by itslef, paying for it, is another challenge.

Step 1: Contact your school's finanical aid office

Step 2: Fill out the FAFSA

Step 3: Borrow money wisely

Step 4: Take advantage of work study funding

Step 5: Apply for national scholarships

Step 6: Find jobs locally near you school

Step 7: Budget your money

This is an article that is giving some steps to help pay for college. Getting into college is hard by itslef, paying for it, is another challenge.

Step 1: Contact your school's finanical aid office

Step 2: Fill out the FAFSA

Step 3: Borrow money wisely

Step 4: Take advantage of work study funding

Step 5: Apply for national scholarships

Step 6: Find jobs locally near you school

Step 7: Budget your money

Length of car loans is increasing

As car prices continue to rise, some auto loan terms have lengthened to a whopping 96 months, or eight years. It's an attempt to make monthly payments more affordable for consumers, but financial experts say such lengthy auto loans can be a bad idea. The average price of a new automobile is $31,200, says Kelley Blue Book. To make that more palatable for consumers, lenders are allowing them to spread payments over more years. In March, nearly one-third of auto loans were for 72 months or longer, a record high, according to J.D. Power and Associates."It used to be that 36 months was considered a standard loan," said Mike Sante, managing editor of Interet.com. Because vehicles last longer today, consumers might justify taking a longer loan. The average age of a vehicle today is 11.

http://azstarnet.com/business/local/length-of-car-loans-is-increasing/article_2ee654e3-99ab-53d4-93cb-af3cd89691f7.html

http://azstarnet.com/business/local/length-of-car-loans-is-increasing/article_2ee654e3-99ab-53d4-93cb-af3cd89691f7.html

SMG’s Finance Degree Ranked Seventh Nationwide by Alums

http://www.bu.edu/today/2013/smg-finance-degree-ranked-seventh-nationwide-by-alums/

tobitsch a graduate from BU has taken what he has l;earned from this college and had a very succesful career so far in the finance world. BU got ranked as 7th in the nation overall.

tobitsch a graduate from BU has taken what he has l;earned from this college and had a very succesful career so far in the finance world. BU got ranked as 7th in the nation overall.

As adults take over entry-level jobs, teenage unemployment hinders job hunting later in life

http://www.thedenverchannel.com/money/as-adults-take-over-entry-level-jobs-teenage-unemployment-hinders-job-hunting-later-in-life

Jobs for teenagers and even young adults are scarce nearly four years after the official end of the Great Recession.The problem with high youth unemployment goes beyond young people not having pocket cash or savings; the bigger problem is that young people who don't work don't have any work experience. Sum said 51.7 percent of teenagers had summer jobs in 2000. Last summer, just 30.5 percent of teens worked during the summer.

Jobs for teenagers and even young adults are scarce nearly four years after the official end of the Great Recession.The problem with high youth unemployment goes beyond young people not having pocket cash or savings; the bigger problem is that young people who don't work don't have any work experience. Sum said 51.7 percent of teenagers had summer jobs in 2000. Last summer, just 30.5 percent of teens worked during the summer.

Court may limit use of race in college admission decisions

http://news.yahoo.com/court-may-limit-race-college-admission-decisions-133238785.html

This article was about how the courts may limit the decisions that a college can make with race. This case was brought up because a girl felt like she was wrongly rejected by a college while minorities with similar grades and test scores were accepted.

This article was about how the courts may limit the decisions that a college can make with race. This case was brought up because a girl felt like she was wrongly rejected by a college while minorities with similar grades and test scores were accepted.

Microsoft Pays Higher Rate to Beat Apple Sale: Corporate Finance

Microsoft is trying to be better than Apple and is failing.

http://www.bloomberg.com/news/2013-04-29/microsoft-pays-higher-rate-to-beat-apple-sale-corporate-finance.html

http://www.bloomberg.com/news/2013-04-29/microsoft-pays-higher-rate-to-beat-apple-sale-corporate-finance.html

Thursday, April 25, 2013

5 Reasons You Shouldn't Give Up On Credit Just Yet

Read more http://www.dailyfinance.com/2013/04/23/credit-cards-best-way-to-pay/#ixzz2RTxW3duP

1) easier disipute resolution

2) better cash or millage rewards

3) Car rental insurance

4) extra travel perks anad pertection

5) Protection on your purchases

1) easier disipute resolution

2) better cash or millage rewards

3) Car rental insurance

4) extra travel perks anad pertection

5) Protection on your purchases

Having Mom Do Your Laundry, to Save Money

http://bucks.blogs.nytimes.com/2013/04/11/having-mom-do-your-laundry-to-save-money/

My mother rolled her eyes. “You have a maid here who does your laundry,” she said. “Me!”

“living with your parents” calculator, The calculator lets you plug in your monthly rent, and other expenses if you choose. It then shows how much you would save if, after college graduation, you live with your parents for four years.There is no doubt living with your parents can save you money, but shouldn’t you be contributing something? Or at least doing your own laundry?

My mother rolled her eyes. “You have a maid here who does your laundry,” she said. “Me!”

“living with your parents” calculator, The calculator lets you plug in your monthly rent, and other expenses if you choose. It then shows how much you would save if, after college graduation, you live with your parents for four years.There is no doubt living with your parents can save you money, but shouldn’t you be contributing something? Or at least doing your own laundry?

Tuesday, April 23, 2013

Time to Overhaul Auto Insurance Laws

http://www.mackinac.org/18548

The change would still leave Michigan with the nation's most generous auto medical coverage. No other state guarantees unlimited, lifetime benefits. As a result of the mandate, the Insurance Industry Institute reports

The change would still leave Michigan with the nation's most generous auto medical coverage. No other state guarantees unlimited, lifetime benefits. As a result of the mandate, the Insurance Industry Institute reports

Twitter Signs Lucrative Deal With Advertising Agency

http://www.nytimes.com/2013/04/23/business/media/twitter-and-starcom-sign-advertising-deal.html?ref=business&_r=0

Twitter signed the deal with the Starcom MediaVest Group which is part of Publicis Groupe. The deal is estimated to be in the hundreds of millions of dollars. According to the president for global revenue at Twitter, the deal will include a virtual lab where the two companies will conduct research that will help advertisers “connect Twitter and TV together".

Twitter signed the deal with the Starcom MediaVest Group which is part of Publicis Groupe. The deal is estimated to be in the hundreds of millions of dollars. According to the president for global revenue at Twitter, the deal will include a virtual lab where the two companies will conduct research that will help advertisers “connect Twitter and TV together".

Wednesday, April 17, 2013

Having Mom Do Your Laundry, to Save Money

http://bucks.blogs.nytimes.com/2013/04/11/having-mom-do-your-laundry-to-save-money/

There was a living with your parents calculator that helped young people see how much they would save living at home than living by yourself renting a place. you would plug in your current rent and the calculator defaults were used to calculate how much you would save living at home.

There was a living with your parents calculator that helped young people see how much they would save living at home than living by yourself renting a place. you would plug in your current rent and the calculator defaults were used to calculate how much you would save living at home.

Boston Marathon bombings: How teams honored the victims of Monday's attack

http://www.sbnation.com/2013/4/17/4233476/boston-marathon-bombings-red-sox-yankees-honor-victims

This article talks about Many sports teams that honored the people that helped and the whole attack. One was that the New England, Patriots donated $100,000 to help those recover in the hospitals and many other more did banners and shirts and things.

This article talks about Many sports teams that honored the people that helped and the whole attack. One was that the New England, Patriots donated $100,000 to help those recover in the hospitals and many other more did banners and shirts and things.

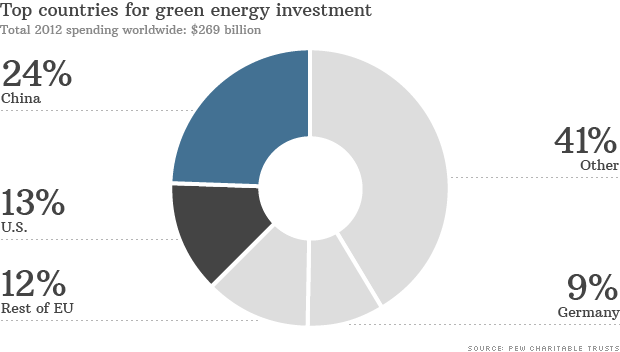

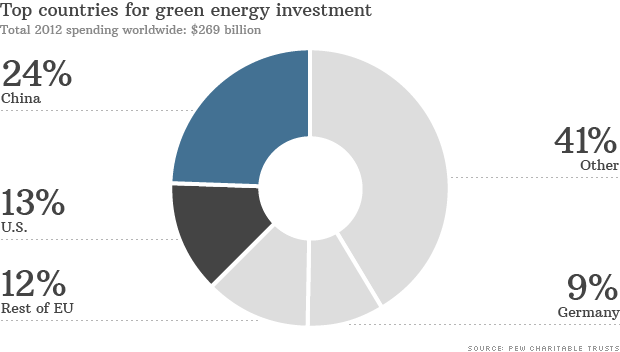

China trounces U.S. in green energy investments

Investors plowed $65 billion into Chinese wind farms, solar panel arrays and other clean energy projects in 2012, a 20% increase over the year prior, according to a report released Wednesday by Pew Charitable Trusts and Bloomberg New Energy Finance. The numbers reflect only private investments in power projects, and do not include government subsidies or R&D money.

Online Auto Insurance: Texting while Driving Penalties Harshest in Alaska, Weakest in Virginia

What could set you back more than $10,000, put you in prison for up to a year, cause you to drive the length of an entire football field basically blindfolded, and increase your insurance rates by around 10 percent in some states? Using your phone to read and send text messages while driving.

According to the study, the following states had the harshest and weakest maximum penalties for a first offense:

Harshest:

- Alaska

- Utah

- Maine

- Wisconsin

- New York

Weakest:

- Virginia

- Iowa

- Indiana

- Delaware

- Pennsylvania

Is a mortgage a smart way to pay for college?

http://www.usatoday.com/story/money/personalfinance/2013/04/13/paying-for-college-mortgage/2071033/

Tis article is about a couple asking this blogger if it would be a good idea to take out a mortgage for their child's college tution, instead of taking out of the retirement money. The couple is debt free at the moment and they feel that taking out a mortgage is a better idea. The blogger tells them that things can go bad for whichever route they take. If they take the money from retirement then if they get laid off, then they have to pay off that loan imeditley or they will face a lot of taxes and penelties. If they take out a mortgage, then they would be putting their home at risk. The blogger said the best way to get the moeny would be to do a home equity loan.

Tis article is about a couple asking this blogger if it would be a good idea to take out a mortgage for their child's college tution, instead of taking out of the retirement money. The couple is debt free at the moment and they feel that taking out a mortgage is a better idea. The blogger tells them that things can go bad for whichever route they take. If they take the money from retirement then if they get laid off, then they have to pay off that loan imeditley or they will face a lot of taxes and penelties. If they take out a mortgage, then they would be putting their home at risk. The blogger said the best way to get the moeny would be to do a home equity loan.

GBC College Knowledge: The Cost of College — and paying for it

http://elkodaily.com/lifestyles/gbc-college-knowledge-the-cost-of-college-and-paying-for/article_c56238c4-a6f0-11e2-bb60-001a4bcf887a.html

There are startling differences ranging from $4,500 to $45,000/year for tuition and fees alone. Books, transportation and living expenses (often another $10,000 to $15,000) will add to the yearly cost of a college education. As such, for a full-time student the cost of attendance can easily range from $15,000 to $60,000 per year.

• Pay As You Go (working your way through college) - allows a person to earn a degree without incurring any college-related debt.

• Using Deferred Payment Plans Available Through Most Colleges - allow a semester’s worth of tuition to be paid in several equal installments.

There are startling differences ranging from $4,500 to $45,000/year for tuition and fees alone. Books, transportation and living expenses (often another $10,000 to $15,000) will add to the yearly cost of a college education. As such, for a full-time student the cost of attendance can easily range from $15,000 to $60,000 per year.

• Pay As You Go (working your way through college) - allows a person to earn a degree without incurring any college-related debt.

• Using Deferred Payment Plans Available Through Most Colleges - allow a semester’s worth of tuition to be paid in several equal installments.

• Scholarships - Colleges and universities typically have a wide range of both merit and need based scholarships ranging in size from $250 to several thousand dollars.

• Grants (both state and federal) - The primary difference between a grant and a loan is that money received as a grant does not need to be paid back; the grant is a gift of sorts.

• Work Study - Work study is a federal grant program that allocates dollars to colleges for use in employing students with financial need at the college.

• Employer Tuition Reimbursement Programs - Many employers offer their employees a tuition reimbursement program as part of their fringe benefits package.

• Guaranteed Federal Loans - These types of loans must be repaid after one completes or stops attending school in 10 to 25 years depending upon the type of loan.

• Alternative Student Loans (Private or Bank Loans) - Some families and individuals prefer to work with their local lending agency and independently borrow the funds necessary to pay for college.

• Credit Cards - With interest rates running from 10-24 percent per year, paying for college with a credit card can be the most expensive method of financing a college education unless one has the means to pay the balance due in full each month

• The FAFSA - Free Application for Federal Student Aid

College students to pay more in tuition

http://www.gainesvilletimes.com/section/6/article/82534/

In Georgia, they have the students pay $32 to $270 more in tuition per semester starting next fall under a budget plan with the Board of Regents. Students have to pay 2.5 percent more. Parents are already complaining about bills, this is just another thing they have to worry about with college funds. It puts them in bigger debt.

In Georgia, they have the students pay $32 to $270 more in tuition per semester starting next fall under a budget plan with the Board of Regents. Students have to pay 2.5 percent more. Parents are already complaining about bills, this is just another thing they have to worry about with college funds. It puts them in bigger debt.

Nine "Free" Credit-Card Benefits You Don't Know You Have

http://www.huffingtonpost.com/smartertravel/best-credit-cards-for-travel-benefits_b_3084701.html

1.Rental-Car Collision Coverage

2.Common-Carrier Lost Baggage

3.Trip Delay/Baggage Delay

4.Roadside Assistance

5.Accident Insurance

6.Trip-Cancellation/Interruption Insurance

7.Airport-Lounge Entry

8.Concierge Services

9.Referral Services

These are the 9 unknown services that are included on credit cards.

1.Rental-Car Collision Coverage

2.Common-Carrier Lost Baggage

3.Trip Delay/Baggage Delay

4.Roadside Assistance

5.Accident Insurance

6.Trip-Cancellation/Interruption Insurance

7.Airport-Lounge Entry

8.Concierge Services

9.Referral Services

These are the 9 unknown services that are included on credit cards.

Stock market rebounds from worst day of the year

http://www.cbsnews.com/8301-505123_162-57579911/stock-market-rebounds-from-worst-day-of-the-year/

This article was about how the stock market recovered from its worst day of the year because of strong housing and earnings reports. The DOW recovered about 3/5 of what it lost on Monday.

This article was about how the stock market recovered from its worst day of the year because of strong housing and earnings reports. The DOW recovered about 3/5 of what it lost on Monday.

Teen Driver's Rule-Breaking is a Red Flag

This article talks about the rule and the consequences for teen drivers if they were to break these rules.

http://www.foxbusiness.com/personal-finance/2013/04/11/teen-driver-rule-breaking-is-red-flag/

http://www.foxbusiness.com/personal-finance/2013/04/11/teen-driver-rule-breaking-is-red-flag/

Monday, April 15, 2013

Teen Driver's Rule-Breaking is a Red Flag

http://www.foxbusiness.com/personal-finance/2013/04/11/teen-driver-rule-breaking-is-red-flag/

This article is about teen drivers and what happens to them after a violation. They were saying that if a teen gets in a crash with other passengers that they shouldn't have yet, the insurance coverage will still be in place for the accident even thought the teen broke the law. Also, if a teen is caught driving other people around when they aren't aloud to yet, the insurance companies will look at that the same way as a driver who blows through a stop sign and crashes. This article tells parents to be out on look about breaking these laws because they could then carry on to breaking the parent's rules too.

This article is about teen drivers and what happens to them after a violation. They were saying that if a teen gets in a crash with other passengers that they shouldn't have yet, the insurance coverage will still be in place for the accident even thought the teen broke the law. Also, if a teen is caught driving other people around when they aren't aloud to yet, the insurance companies will look at that the same way as a driver who blows through a stop sign and crashes. This article tells parents to be out on look about breaking these laws because they could then carry on to breaking the parent's rules too.

As Child Care Costs Rise, Families Seek Alternatives

http://www.nytimes.com/2013/04/04/us/child-care-costs-are-up-census-finds.html?ref=your-money&_r=0

More and more people are not taking their children to Child Care services, but taking them to relatives or after-school programs. Child Care services are not inexpensive and there has been a trend lately showing that less and less people are using them.

More and more people are not taking their children to Child Care services, but taking them to relatives or after-school programs. Child Care services are not inexpensive and there has been a trend lately showing that less and less people are using them.

SPAIN: Parents should avoid paying kids’ college education

http://rapidcityjournal.com/business/spain-parents-should-avoid-paying-kids-college-education/article_5d35f361-0ac5-5b84-8b5c-deeba5f50c9b.html

This article is about how Spain thinks it's best to avoid paying for kids' college. It is too big of a hassle and too many parents either lose jobs or get divorced. Its a big upset when parents get into a big financial snag and they have nowhere to go with their money. They can't find a way to pay for their kids college. Medical bills raise the roof if a family member has a medical condition. It's hard for money and it especially doesn't grow on trees.

This article is about how Spain thinks it's best to avoid paying for kids' college. It is too big of a hassle and too many parents either lose jobs or get divorced. Its a big upset when parents get into a big financial snag and they have nowhere to go with their money. They can't find a way to pay for their kids college. Medical bills raise the roof if a family member has a medical condition. It's hard for money and it especially doesn't grow on trees.

Airplane inspections!

http://www.chicagotribune.com/business/breaking/chi-boeing-737-inspections-faa-orders-inspections-of-737-20130415,0,4666898.story

This article talks aobut the FAA ordering inspections of 737 jet airliners. This will help to prevent future accidents with the tail of the plane with faulty parts. It will effect 1050 aircraft flown by airlines in the US and cost $9,627 per air craft that adds up to 10108350 dollars

This article talks aobut the FAA ordering inspections of 737 jet airliners. This will help to prevent future accidents with the tail of the plane with faulty parts. It will effect 1050 aircraft flown by airlines in the US and cost $9,627 per air craft that adds up to 10108350 dollars

How Investing Dimes Can Beat Dollars

http://online.wsj.com/article/SB10001424127887324050304578410840698473554.html?mod=googlenews_wsj

Burton Malkiel, the renowned economist and author of "A Random Walk Down Wall Street, suggests that in order to ease into the market safely and most effectively spread the money out in which you want to invest. Especially if you are a little late to invest in something big.

Burton Malkiel, the renowned economist and author of "A Random Walk Down Wall Street, suggests that in order to ease into the market safely and most effectively spread the money out in which you want to invest. Especially if you are a little late to invest in something big.

http://money.usnews.com/money/personal-finance/articles/2013/04/01/when-frugality-goes-too-far

Being frugal

It is often that in The United States right now; many people are being frugal and not spending as much money as they could. Manisha Thakor, (Founder of MoneyZen) who is an investor, says that this can be good, but should not be allowed to cut into joy. She also sees innapropriate investment choices due to frugality. In this article, it explains that money is an asset, which in turn is what is being traded to another person for a product or labor or whatever this is.

It is in this instance in the economic system that is hindering the prosperity of the overall economy in The United States.

Being frugal

It is often that in The United States right now; many people are being frugal and not spending as much money as they could. Manisha Thakor, (Founder of MoneyZen) who is an investor, says that this can be good, but should not be allowed to cut into joy. She also sees innapropriate investment choices due to frugality. In this article, it explains that money is an asset, which in turn is what is being traded to another person for a product or labor or whatever this is.

It is in this instance in the economic system that is hindering the prosperity of the overall economy in The United States.

Getting out of credit card debt is possible without a miracle

http://www.thestarpress.com/article/20130415/NEWS01/304150014/Getting-out-credit-card-debt-possible-without-miracle?nclick_check=1

Four years ago, journalist had 17,000 dollars in credit card debt.

“We’re seeing more and more of that. (Credit card debt) is a toxic debt and we try to get people to pay it off as soon as possible,” said a financial adviser with Edward Jones in Yorktown. “We’re also seeing people who are using the cards to meet their need from week to week and month to month and then it spirals.”

I’d use the cards to pay for groceries, gas, electric bills, anything that I thought was only a few dollars that wouldn’t add up, but of course they did.

Getting out of credit card debt isn't easy for anyone. With a 17-percent annual interest rate on one of my cards, it was almost impossible.

But with a budget that was not fun to follow, I cut food, travel and spending costs immediately by cooking at home, riding my bike more often and passing on Indianapolis and Chicago as my entertainment spots.

Friday morning, the fours years of hard work was finally complete when my last credit card payment hit my account.

This is all called living within my means.

Four years ago, journalist had 17,000 dollars in credit card debt.

“We’re seeing more and more of that. (Credit card debt) is a toxic debt and we try to get people to pay it off as soon as possible,” said a financial adviser with Edward Jones in Yorktown. “We’re also seeing people who are using the cards to meet their need from week to week and month to month and then it spirals.”

I’d use the cards to pay for groceries, gas, electric bills, anything that I thought was only a few dollars that wouldn’t add up, but of course they did.

Getting out of credit card debt isn't easy for anyone. With a 17-percent annual interest rate on one of my cards, it was almost impossible.

But with a budget that was not fun to follow, I cut food, travel and spending costs immediately by cooking at home, riding my bike more often and passing on Indianapolis and Chicago as my entertainment spots.

Friday morning, the fours years of hard work was finally complete when my last credit card payment hit my account.

This is all called living within my means.

4 Ways to Lower Your Auto Insurance Costs

1.)Safety Equipment Discounts- These days most new cars come standard with safety features that not only protect the drivers in an accident, but can save on auto insurance.

2.)Multi-Car and Multi-Policy Discounts- Insurance companies make more money by keeping their customers long term, so they may be willing to offer long-term customers more discounts.

3.)Accident Free Discounts- Staying accident free for three years will also save drivers money, granted they haven’t received any moving violations during that time frame, according to the Independent Insurance Agents & Brokers of America.

4.)Good Student Discount- There’s another reason high-school age children should get good grades: Many insurance companies offer discounts for students age 16 to 24 who maintain at least a B average of a 3.0 GPA or is on the Dean’s List or Honor Roll, according to the Department of Motor Vehicles.

2.)Multi-Car and Multi-Policy Discounts- Insurance companies make more money by keeping their customers long term, so they may be willing to offer long-term customers more discounts.

3.)Accident Free Discounts- Staying accident free for three years will also save drivers money, granted they haven’t received any moving violations during that time frame, according to the Independent Insurance Agents & Brokers of America.

4.)Good Student Discount- There’s another reason high-school age children should get good grades: Many insurance companies offer discounts for students age 16 to 24 who maintain at least a B average of a 3.0 GPA or is on the Dean’s List or Honor Roll, according to the Department of Motor Vehicles.

Why Facebook Could Finance Your Next Phone

http://www.wired.com/business/2013/04/facebook-phone-subsidy/

Facebook Home was released last week for six new high-end smartphones. Here’s how it might work: Facebook could offer to pay mobile subscribers’ out-of-pocket costs for a device like, say, the $200 Samsung Galaxy Note II. In exchange, Facebook Home would be allowed to show advertisements a bit more often on the device and to report back a bit more tracking data than it normally does (Facebook says Facebook Home tracks only the same data as Facebook’s mobile app, plus some anonymized app launching stats on rare occasion).

Facebook Home was released last week for six new high-end smartphones. Here’s how it might work: Facebook could offer to pay mobile subscribers’ out-of-pocket costs for a device like, say, the $200 Samsung Galaxy Note II. In exchange, Facebook Home would be allowed to show advertisements a bit more often on the device and to report back a bit more tracking data than it normally does (Facebook says Facebook Home tracks only the same data as Facebook’s mobile app, plus some anonymized app launching stats on rare occasion).

'Money Matters': Teen's hip-hop video on finances wins award

http://blogs.sacbee.com/personal-finance-ask-the-experts/2013/04/money-matters-teens-winning-hip-hop-video-on-finances.html

Most hip hop talks about spending money and not saving it, but in a recent contest a group of teen wrote a rap that talked about personal finance winning $3000 in price money.

Most hip hop talks about spending money and not saving it, but in a recent contest a group of teen wrote a rap that talked about personal finance winning $3000 in price money.

Obama Axes Abstinence Education Funding From Federal Budget

http://christiannews.net/2013/04/13/obama-axes-abstinence-education-funding-from-federal-budget/

The National Abstinence Education Association (NAEA) issued an alert over the matter on Wednesday, noting that Sexual Risk Avoidance (SRA) abstinence education funds were cut from the budget.

This article is about Obama cutting funding for abstinence programs and the response they have to it.

“The president’s move to eliminate Sexual Risk Avoidance (SRA) abstinence programs is completely out of touch with what his base wants, what parents want, and what is in the best interest of America’s youth,” stated NAEA president Valerie Huber. “It’s troubling that the president would want to prevent students from receiving the encouragement and skills to avoid sexual risk.”

The Article goes on to give statistics about abstinence programs and how they prevent teen pregnancy and how girls are less likely to engage in "Sexual Risk" behavior when they have had abstinence preaching.

The National Abstinence Education Association (NAEA) issued an alert over the matter on Wednesday, noting that Sexual Risk Avoidance (SRA) abstinence education funds were cut from the budget.

This article is about Obama cutting funding for abstinence programs and the response they have to it.

“The president’s move to eliminate Sexual Risk Avoidance (SRA) abstinence programs is completely out of touch with what his base wants, what parents want, and what is in the best interest of America’s youth,” stated NAEA president Valerie Huber. “It’s troubling that the president would want to prevent students from receiving the encouragement and skills to avoid sexual risk.”

The Article goes on to give statistics about abstinence programs and how they prevent teen pregnancy and how girls are less likely to engage in "Sexual Risk" behavior when they have had abstinence preaching.

How Investing Dimes Can Beat Dollars

Do not invest a ton of money at once. Instead, invest smaller amounts over a period of time.

http://online.wsj.com/article/SB10001424127887324050304578410840698473554.html?mod=googlenews_wsj

http://online.wsj.com/article/SB10001424127887324050304578410840698473554.html?mod=googlenews_wsj

Facebook could help pay for your next phone.

http://www.wired.com/business/2013/04/facebook-phone-subsidy/

Due to the competitive market,facebook had been giving dicsounts on phones that are compatible with the facebook app. Just last week, the facebook app was released for six new smart phones.

Due to the competitive market,facebook had been giving dicsounts on phones that are compatible with the facebook app. Just last week, the facebook app was released for six new smart phones.

Thursday, April 11, 2013

New-car loans hit record 65 months

http://www.autonews.com/article/20130410/FINANCE_AND_INSURANCE/130409885/new-car-loans-hit-record-65-months#axzz2QA0xgIni

buyers are waiting to pay so it becomes cheaper and a lot smarter.

buyers are waiting to pay so it becomes cheaper and a lot smarter.

Financing for Dolphins' stadium upgrades could include $150M NFL loan

Financing scenarios for the Miami Dolphins’ Sun Life Stadium upgrades could include a $150 million loan obtained through the National Football League, according to an independent assessment.

The assessment was provided to Miami-Dade County Commissioners for a special meeting Wednesday to review the team’s proposed funding deal.

Coral Gables-based Public Financial Management said in its assessment that it reviewed the audited financials for both the Dolphins and the stadium. Noting it was outside the scope of its review, PFM added that the team “will be eligible for approximately $150 million of NFL lending” through the NFL G4 Loan program.

Local students get lesson on personal finance

http://www.kmtr.com/news/local/story/Local-students-get-lesson-on-personal-finance/yU8OuuwWd0qxlLztgW3u5g.cspx

Schools werent understanding why schools werent teaching students about financing, so they started teaching students everything they need about financing their future finances.

Schools werent understanding why schools werent teaching students about financing, so they started teaching students everything they need about financing their future finances.

Paying college athletes can work

http://msn.foxsports.com/collegebasketball/story/jason-whitlock-paying-college-athletes-can-work-if-you-follow-these-steps-041013

This article is about how getting paid for college can work. Paying for college is a lot of money but if you get student loans, it's the best way to finish and continue getting money for college. College athletes have to pay the most.

This article is about how getting paid for college can work. Paying for college is a lot of money but if you get student loans, it's the best way to finish and continue getting money for college. College athletes have to pay the most.

The Irony of "Financial Literacy Month"

The article basically says how the author thinks "Financial Literacy Month" is ironic because you shouldn't devote just a month to it, it's an ongoing process.

http://www.huffingtonpost.com/dan-solin/financial-illiteracy-is_b_3027725.html

http://www.huffingtonpost.com/dan-solin/financial-illiteracy-is_b_3027725.html

Local students get lesson on personal finance

http://www.kmtr.com/news/local/story/Local-students-get-lesson-on-personal-finance/yU8OuuwWd0qxlLztgW3u5g.cspx

Students in a town in Oregon got a lesson about personal finance through the Junior Achievement Mobile Finance Park. There are 16 mini-businesses that come to this, from insurance agents, Realtors, and banks. Students have a budget that is developed off of real-life situations. This gives the students a look into how to spend your money and how to manage it.

Students in a town in Oregon got a lesson about personal finance through the Junior Achievement Mobile Finance Park. There are 16 mini-businesses that come to this, from insurance agents, Realtors, and banks. Students have a budget that is developed off of real-life situations. This gives the students a look into how to spend your money and how to manage it.

Gold, Long a Secure Investment, Loses Its Luster

http://www.nytimes.com/2013/04/11/business/gold-long-a-secure-investment-loses-its-luster.html?ref=business&_r=0

Wall Street analysts are declaring the end of a golden age of gold. The value of gold has only been decreasing. The value of gold has decreased by 17% since 2011 and this was not foreseen at all.

Wall Street analysts are declaring the end of a golden age of gold. The value of gold has only been decreasing. The value of gold has decreased by 17% since 2011 and this was not foreseen at all.

Local students get lesson on personal finance

http://www.kmtr.com/news/local/story/Local-students-get-lesson-on-personal-finance/yU8OuuwWd0qxlLztgW3u5g.cspx

TheJunior Achievement Mobile Finance is going around teaching middle schools about finance. Finance Park

The

Frugality comeback

http://www.dispatch.com/content/stories/editorials/2013/04/09/frugality-comeback.html

Survey finds many Americans are managing finances more carefully

- 56 percent say their financial outlook has shifted from scared or confused to confident or prepared.

- 35 percent had endured a large drop in income; 17 percent of breadwinners had lost a job; and, on average, households had lost 34 percent of the value of their assets during the recession.

- 42 percent regularly contribute more to workplace savings plans, including retirement or health-savings accounts; 72 percent report having less debt; and 42 percent are saving more for emergencies.

While today’s college students may be questioning whether they’ll ever be able to afford their parents’ lifestyle, given a scarcity of jobs and high tuition rates, new data shows it still pays to go to college.

According to a January report from U.S. Bureau of Labor Statistics, those with a college degree typically earned $1,066 a week during 2012. This compares with $652 a week for high-school graduates.

College also insulates people from unemployment; the rate for high-school graduates in 2012 was 8.3 percent; it was just 4.5 percent for those with a bachelor’s degree.

Wanna invest like Buffett? There's an app for that

http://buzz.money.cnn.com/2013/04/10/buffett-ibillionaire-app/

There is an app called iBillionaire that makes it easier to invest. It keeps track of what Warren Buffet and other investors are selling and buying. You can see their portfolios. It costs $4.99

There is an app called iBillionaire that makes it easier to invest. It keeps track of what Warren Buffet and other investors are selling and buying. You can see their portfolios. It costs $4.99

OPINION: Frugality

http://www.starherald.com/opinion/opinion-frugality/article_6d003250-a0bd-11e2-9835-001a4bcf887a.html

Recent times have changed the way the middle class america lives - in many ways for the better

Fidelity Investments, the nation’s second largest mutual fund company, said in releasing results of its “Five Years After” survey of nearly 1,200 investors that some Americans are showing more fiscal responsibility, including saving more in 401(k) plans, paying down debt and taking greater care to invest wisely.

Recent times have changed the way the middle class america lives - in many ways for the better

Fidelity Investments, the nation’s second largest mutual fund company, said in releasing results of its “Five Years After” survey of nearly 1,200 investors that some Americans are showing more fiscal responsibility, including saving more in 401(k) plans, paying down debt and taking greater care to invest wisely.

In shortchanged economy, personal finance course should be required for college students

http://www.wildcat.arizona.edu/article/2013/04/in-shortchanged-economy-personal-finance-course-should-be-required-for-college-students

Forbes went public on Monday with new data reflecting a much higher unemployment rate than previously reported: 14.3 percent. That means that, more than ever, students can’t count on finding a job immediately after graduation, and student loan debt is still climbing. Students need to learn how to manage their finances while they’re still in college. Arizona’s general education curriculum was established to provide graduates with a foundation in the modernized liberal arts, but with today’s shaky employment prospects, college students don’t have the time — or the cash — previous generations had to become “well-rounded.” It’s time for universities to shake up their general education curriculum with courses like personal finance, to better equip students for the 21st century workplace.

Forbes went public on Monday with new data reflecting a much higher unemployment rate than previously reported: 14.3 percent. That means that, more than ever, students can’t count on finding a job immediately after graduation, and student loan debt is still climbing. Students need to learn how to manage their finances while they’re still in college. Arizona’s general education curriculum was established to provide graduates with a foundation in the modernized liberal arts, but with today’s shaky employment prospects, college students don’t have the time — or the cash — previous generations had to become “well-rounded.” It’s time for universities to shake up their general education curriculum with courses like personal finance, to better equip students for the 21st century workplace.

College debt

http://www.wbur.org/npr/176594590/debt-and-the-modern-parent-of-college-kids

"On average, students graduate from college in the U.S. with $25,000 in debt"

This article talks about the many things you have to consider when putting your child through college. Such as private school vs Public.

Burger King Says Finance Chief Schwartz to Become CEO

Burger King changes their chief executive officer.

http://www.bloomberg.com/news/2013-04-11/burger-king-says-finance-chief-schwartz-to-become-ceo.html

http://www.bloomberg.com/news/2013-04-11/burger-king-says-finance-chief-schwartz-to-become-ceo.html

Wanna invest like Buffett? There's an app for that

iBillionaire, which launched Wednesday, tracks what Warren Buffett, Carl Icahn, Bill Ackman and other financial titans are buying and selling. The app also comes with a Google news feed that automatically updates news about the billionaires and the stocks they own. Currently the app only tracks data back to 2009 but the next version will go back to 2002. There's a free preview of the app. The full version costs $4.99.

Car loans getting longer; more buyers financing for up to 7 years

http://editorial.autos.msn.com/blogs/autosblogpost.aspx?post=dc0ef557-83d2-4734-9bd7-01ca4481eee0

Car loans have been becoming something that has really started to increase. The interest rates are lower and people are deciding that it is a good time to go and buy a car.

Car loans have been becoming something that has really started to increase. The interest rates are lower and people are deciding that it is a good time to go and buy a car.

New-car loans hit record 65 months

http://www.autonews.com/article/20130410/FINANCE_AND_INSURANCE/130409885/new-car-loans-hit-record-65-months#axzz2QA0xgIni

Car loans are now longer because buyers want to pay less, so they will stretch their time to pay less money.

Car loans are now longer because buyers want to pay less, so they will stretch their time to pay less money.

Tuesday, April 9, 2013

Personal Finance: Not all is lost if you save

http://www.naplesnews.com/news/2013/apr/08/personal-finance-not-all-is-lost-if-you-save/

This article was about people and their finances when they retire. There were many Americans that in doubt about their futrue when they retire. About 13% of Americans are very confident that they are going to have the money they will need some day for retirement and 38% of Americans are somewhat comfident. They gave amny events that led up to people becoming afraid. With that, they also recommended that you should be proactive and all that so more people can be in the very confident zone when they retire.

This article was about people and their finances when they retire. There were many Americans that in doubt about their futrue when they retire. About 13% of Americans are very confident that they are going to have the money they will need some day for retirement and 38% of Americans are somewhat comfident. They gave amny events that led up to people becoming afraid. With that, they also recommended that you should be proactive and all that so more people can be in the very confident zone when they retire.

Homebuyers have financing options

Changes by the Federal Housing Authority that went into effect April 1 may motivate some buyers to speed up the process if they are considering an FHA loan.

Yet while many homebuyers are scrambling to take advantage of current regulations, as well as historical low interest rates and prices that could rise, Jim Ruth, senior loan officer with First Cal Colorado, cautions buyers to take their time.

“People should be buying because they want to buy a house,” Ruth said. “A lot of people sometimes will rush it, and they might buy something they don’t really want. When people are coming up on deadlines, such as for the $8,000 tax credit a couple years ago, I had people buying just so they could get that credit.”

One of the factors that Ruth sees is that new FHA regulations dictate that homebuyers not under contract by June 3 will have to pay mortgage interest for the life of the loan, instead of having it drop off once the amount owed is down to 78 percent of the original loan amount.

FHA loans are very tempting now, Ruth said, coming in about a half-point lower than conventional loans and hovering around 3.3 percent to 3.5 percent, but paying mortgage insurance for 30 years can add $40,000 in cost to a $200,000 home over the life of the loan.

“There are a lot of other programs available out there,” Ruth said. “Don’t panic over the changes. It’s important to sit down with your lender about six months before you buy and make sure you are aware of all your options and that your credit is in order.

“If you’re credit isn’t good, it may be able to fixed in as little as six months to a year.”

The Colorado Housing Finance Authority, which First Cal Colorado is affiliated with, has multiple programs available. One of those, the Mortgage Credit Certificate program, is designed for one- or two-person households making less than $79,300, or three-person households making less than $91,100, who haven’t owned a home in the last three years.

Seven steps to paying for college

http://www.ajc.com/news/business/seven-steps-paying-college/nXDgd/

Step 1

“Contact your school’s financial aid office

Step 2

“Fill out the FAFSA

Step 3

Borrow money wisely.

Step 4

Take advantage of work-study funding

Step 5

Apply for national scholarships.

Step 6

Beat the bushes locally

Step 7

Budget your money.

World Briefly: Obama says he’s ’determined as ever’ for gun bill

http://www.yourhoustonnews.com/courier/news/world-briefly-obama-says-he-s-determined-as-ever-for/article_babc5af9-4847-57ab-b5e2-240d3cfc5cdf.html

Obama's bringing 11 relatives of those killed at Connecticut’s Sandy Hook Elementary School so they can attend his gun control speech, and then plead with senators reluctant to back gun legislation.

Obama's bringing 11 relatives of those killed at Connecticut’s Sandy Hook Elementary School so they can attend his gun control speech, and then plead with senators reluctant to back gun legislation.

The White House says Obama is going to argue in his speech that lawmakers have an obligation to the children killed and other victims of gun violence to allow an up-or-down vote in the Senate.

Luxembourg undecided on bank data exchange deal: finance minister

Luxembourg is considering ending its bank secrecy rules by automatically handing over details of bank account holders to other European Union states, its finance minister said on Tuesday.

The European Commission wants all 27 EU member states to strengthen rules on how income on savings held in bank accounts is taxed, including an automatic exchange of information about which account holders receive what interest payments.

U.S., German finance chiefs downplay differences

http://www.cbsnews.com/8301-505123_162-57578584/u.s-german-finance-chiefs-downplay-differences/

Germanies finance minister is wanting to lower deficits because he doesnt believe it will weaken the economy. He is doing this to try and help europe as a whole and is acting on his own doesnt care what our finance guy says.

Germanies finance minister is wanting to lower deficits because he doesnt believe it will weaken the economy. He is doing this to try and help europe as a whole and is acting on his own doesnt care what our finance guy says.

Teacher Knows if You’ve Done the E-Reading

http://www.nytimes.com/2013/04/09/technology/coursesmart-e-textbooks-track-students-progress-for-teachers.html?ref=business&_r=0

CourseSmart E-Textbooks are a new piece of high technology that allows a teacher to know when you're skipping pages, not highlighting important information, not taking notes and not opening the book. I think this is a really clever idea that teachers can use for their teaching habits. Noticing trends in the book habits and the students' grades can only make them better.

CourseSmart E-Textbooks are a new piece of high technology that allows a teacher to know when you're skipping pages, not highlighting important information, not taking notes and not opening the book. I think this is a really clever idea that teachers can use for their teaching habits. Noticing trends in the book habits and the students' grades can only make them better.

The Stock Market Is Making A 'Christmas Tree' Pattern

http://www.businessinsider.com/stock-market-alternating-streak-2013-4

The stock market for 14 straight sessions has been alternating up and down. People have been calling it the 'Christmas Tree Pattern" with it's green and red colors. The results have been closely matched with the 1563 results.

The stock market for 14 straight sessions has been alternating up and down. People have been calling it the 'Christmas Tree Pattern" with it's green and red colors. The results have been closely matched with the 1563 results.

Army E-6, teen recruit found dead in Maryland

http://www.armytimes.com/article/20130409/NEWS02/304090002/Army-E-6-teen-recruit-found-dead-Maryland

This article was about a girl who was signed up to go into the Army reserves right after her graduation from Rockville High School this spring, her father said. She had wanted to go into the Army since elementary school. “She wanted to serve her country, she wanted to see the world, she wanted to finance her education,” her father, Kevin Miller, said from his Rockville home Monday evening. Michelle Miller, 17, was found dead Monday morning at the Germantown home of Staff Sgt. Adam Anthony Arndt. Montgomery County Police said Arndt shot her and then fatally shot himself. Detectives say the 31-year-old Arndt was assigned to coordinate Miller’s entry into the reserves. Kevin Miller said his daughter left their Rockville home about 9:15 p.m. Sunday, saying somebody in her platoon was suicidal. Kevin Miller said he was against that, but his daughter said she would be fine and promised to text him the address when she arrived. “She had her life taken away from her on one fell swoop,” he said. Miller described his daughter as a “stunningly beautiful girl.” She wanted to be a psychotherapist and planned to go to college in Arizona, Miller said. She only needed credit to graduate from high school, but still took several classes, including courses at Montgomery College. Michelle lettered in basketball, soccer and lacrosse. Miller said she was supposed to play in a lacrosse game Monday night.

This article was about a girl who was signed up to go into the Army reserves right after her graduation from Rockville High School this spring, her father said. She had wanted to go into the Army since elementary school. “She wanted to serve her country, she wanted to see the world, she wanted to finance her education,” her father, Kevin Miller, said from his Rockville home Monday evening. Michelle Miller, 17, was found dead Monday morning at the Germantown home of Staff Sgt. Adam Anthony Arndt. Montgomery County Police said Arndt shot her and then fatally shot himself. Detectives say the 31-year-old Arndt was assigned to coordinate Miller’s entry into the reserves. Kevin Miller said his daughter left their Rockville home about 9:15 p.m. Sunday, saying somebody in her platoon was suicidal. Kevin Miller said he was against that, but his daughter said she would be fine and promised to text him the address when she arrived. “She had her life taken away from her on one fell swoop,” he said. Miller described his daughter as a “stunningly beautiful girl.” She wanted to be a psychotherapist and planned to go to college in Arizona, Miller said. She only needed credit to graduate from high school, but still took several classes, including courses at Montgomery College. Michelle lettered in basketball, soccer and lacrosse. Miller said she was supposed to play in a lacrosse game Monday night.

Seven steps to paying for college

http://www.ajc.com/news/business/seven-steps-paying-college/nXDgd/

This article shows the 7 steps in the best way to pay for college. It describes how to contact your school's office and borrow money wisely. It has you experience the college life by yourself and how beneficial things could be when you pay for college in a step by step process.

This article shows the 7 steps in the best way to pay for college. It describes how to contact your school's office and borrow money wisely. It has you experience the college life by yourself and how beneficial things could be when you pay for college in a step by step process.

College Admissions: Ivy League Acceptance Rates Decline

http://nation.time.com/2013/04/02/ivy-league-schools-accepting-even-fewer-kids/

This article was about how Ivy League colleges are accepting a smaller percentage of their applicants. The colleges are being more selective and the reason that the percentage is lower is because there are more students applying for these colleges. They are getting more applicants than they can accept.

This article was about how Ivy League colleges are accepting a smaller percentage of their applicants. The colleges are being more selective and the reason that the percentage is lower is because there are more students applying for these colleges. They are getting more applicants than they can accept.

Michelle Miller, 17 found dead.

http://www.armytimes.com/article/20130409/NEWS02/304090002/Army-E-6-teen-recruit-found-dead-Maryland

Michelle Miller, 17, was found dead Monday morning at the Germantown home of Staff Sgt. Adam Anthony Arndt.

It is believed that Michelle had feelings for Adam. Adam shot Michelle and then shot himself. Michelle was very active in sports and had her fujture planned out. It is very unfortunate that this happened to her.

Michelle Miller, 17, was found dead Monday morning at the Germantown home of Staff Sgt. Adam Anthony Arndt.

It is believed that Michelle had feelings for Adam. Adam shot Michelle and then shot himself. Michelle was very active in sports and had her fujture planned out. It is very unfortunate that this happened to her.

Subscribe to:

Posts (Atom)